Caliber Home Loans for Android is a mobile command center made especially for people working through the mortgage process, whether they’re purchasing their first home or managing an existing loan with this national lender.

What do you actually get after download

This app connects the borrower to the lending system of Caliber digitally. You can check your mortgage application process in real-time, upload scanned documents with ease, search for nearby loan consultants when you need human help, and much more. When sending tax returns and bank statements from your phone, secure sharing protocols matter. Luckily, your cranky electronic devices won’t matter.

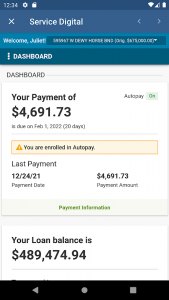

Your loan has closed, so now the app is for accounts. You’ll see tools to set up recurring payment set up or make a one-time payment, check escrow management, view payment history and send in a request to drop private mortgage insurance when you reach 20% equity. With the help of real-time mortgage milestone notifications, you don’t have to constantly check the system. Profile management feature lets you update your contact details and preferences if your situation changes.

The interface has these versions but is not complex. Business users get companion functionality for pipeline tracking and loan pricing, turning the platform into a collaborative workspace where everyone can keep track of what is going on at once.

Important Limits You Should Be Aware

The truth is, this app only offers value in Caliber’s ecosystem. There is no reason to keep it if you aren’t a Calibre customer or business partner. The loan consultant finder and application tracking tools are useless if you do not have an active relationship with the company.

Another limitation may exist as per user feedback. To use the app for its main features you need an internet connection. It is not clear how robust the offline functionality is. In all likelihood, you won’t be able to view your documents or check your balance. According to some reports from the overall mortgage community, the app does not feature as advanced financial-management tools as other players in the game. So, for example, you will not find budgeting tools, refinance calculators as well as third-party account aggregation that Rocket Mortgage or Wells Fargo offer.

Who profits from the monetary inquiry

At the moment, there are no ads or in-app purchases and it’s free! Caliber imagined it as a service layer to existing customers rather than a revenue generator itself.

This tool is best for engaged Caliber borrowers who prefer visibility during the application process and easy payment management thereafter. Tracking the mortgage application and seeing escrow account activity can help lessen the stress of this financial transaction. If you constantly work with Caliber’s loan pipeline, you’ll love its real-time coordination features. Unless you are borrowing between lenders or looking for a full mortgage comparison tool, this is not it. This website is for one business only and therefore does not have mass appeal. It does have narrow appeal to the audience it serves.

No comments yet :(