CTOS for Android is a credit monitoring & fraud protection app that is uniquely built for Malaysian consumers. With CTOS for Android, users can manage their financial identity and creditworthiness.

What’s Inside the App?

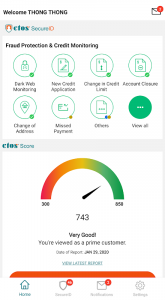

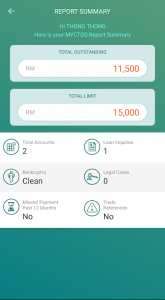

Essentially, CTOS gives you direct access to your “credit report”, which includes your CTOS Score that is used by lenders in Malaysia to vet your creditworthiness. You can search for “litigation records,” bankruptcy filings, and trade references that reveal outstanding debt incurred under your name. Just being able to see this makes it worth getting if you are looking to apply for a loan or mortgage of any kind as you will know exactly what the banks see when they pull your file.

The real star here is CTOS SecureID which acts like a digital guard for your financial identity. The app scans dark web to detect leakage of your personal information, sends immediate « fraud alerts » to warn you when someone tries to open credit in your name, and informs you when credit limits change, accounts close or addresses are amended. You’ll get scam alert warnings and monthly reminder of missed payments to keep ahead of damaging your credit health. Not only that, this app also provides you a takaful coverage of RM20,000 for loss of identity (due to identity theft). That’s more than just a credit score tracker.

The app lets you edit your profile to fix any inaccuracies in your report. And, you’ll get updates on your credit score regularly so you can track if it improves or detect problems early. It is offered to you free of charge.

Limitations of Data and Geography

The catch is that only Malaysians can get CTOS. You cannot use this app if you live outside Malaysia or do not have a Malaysian identity card. Some users have noticed that the data in the app can be wrong. This is because the app relies on the information provided by banks and financial institutions. If they miss something or report later than normal, your report will be out of date. Also, you must have a constant internet connection to view your «credit report» and notifications offline. This can be annoying when travelling or you are having poor networks.

Who Should Download It

CTOS designed this for Malaysians, who want to actively monitor their credit and protect their identity without a fee. Having credit monitoring becomes all the more beneficial when you’re managing debt, planning a big purchase, or simply feel better knowing your profile is under surveillance. The Malaysian credit bureau integration and localized fraud alerts give this platform an edge in its own home market that international apps cannot match. This app is not suitable if you are outside of Malaysia or when it is offline. For the rest of the country, it is a practical and no-charge means of securing your credit report and identity.

No comments yet :(