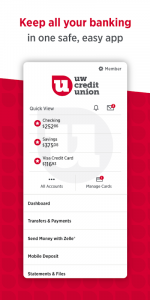

The mobile banking app allows users to carry out essential financial tasks from just one location. Members can deposit checks with their camera or lock a missing debit card.

What you will obtain upon logging in

You can manage all of your money on the go with this app. You can see your balances and transaction history for checking, savings, loans, mortgages, and credit cards without changing the screen. Checking deposit on your mobile phone takes just seconds using your camera to snap and submit a photo of the check. Zelle handles person-to-person transfers when you need to split-a-bill and send cash to family. Bill payments can be a one-time payment or set up on a schedule while fund transfers move money from your accounts or others.

Managing debit cards is what helps here. If something doesn’t seem right, you can instantly lock and unlock your cards, order replacements, change your PIN, or modify your credit limit without calling Customer Support. You can dispute transactions and stop payments easily, saving you a lot of time. You can see what you have earned and redeem points directly with the “credit card rewards” tracking. Know your credit score in real-time and get full-access to your credit report minus the hit to your credit score.

The app also deals with ‘personal finance management’, categorised transactions, spending tracking, goal-setting tools that show how the money is spent each month. You can stay notified due to real-time notifications and balance alert. You can also use the «ATM locator» to find nearby surcharge-free ATMs. When you send a message, it will be reachable by the financial specialist. The lending offer you receive is personalized. It will have no impact on your credit score and is based on your profile. With two-step authentication and enhanced security functions everything is tied down correctly.

The Trouble with This Setup

The truth is, you will likely need an internet connection for almost everything because offline functionality is basically nonexistent. Users say the app sometimes has bugs or misbehaves. Interesting, the app gets updates from time to time to fix it. If you’re seeking a new banking app, you might find it’s rather limiting that the app is mostly helpful for existing UW Credit Union members. It may be downloaded free of charge and does not have in-app purchases. However, it is filled with ads from other advertisements.

Who is This Application Actually For

Imagine you’re a member of the UW Credit Union who has several accounts, monitors spending goals, and is constantly on the go spending money. You’re trying to get to «wire transfers» or «mobile deposits». This app handles that scenario well. It comes with tools like ATM locators and other tools useful for redeeming credit card rewards and credit score monitoring. Many competing bank apps steal-charge customers for credit score monitoring alone.

But if you’re not a member or you need strong offline capabilities, the app won’t be for you. The ads can get annoying and the app can freeze a little, though this is fixed in the updates. For existing members who believe in the importance of convenience, security and integrated “personal finance management” rather than linking third-party applications, this “Mobile Banking” platform offers just that, and at no extra charge. If you are already using a credit union, it is a good choice. But there are better options if you are just a casual browser.

No comments yet :(