ONE@Work (formerly Even) for Android is a workplace-based financial wellness app that tackles a problem millions of employees face: waiting two weeks for money you’ve already earned.

What You Receive Within the Application

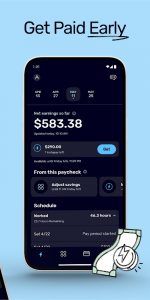

Instapay is the main feature here that works as a pressure release in your paycheck. You don’t have to sit back and watch the bills pile up while your earned wages are locked in your employer’s payroll system. You can access up to 50% of the money you have already earned before payday. This isn’t a loan or line of credit, it’s your money delivered early. The app has many automated saving features that allow you to reserve portions of your paycheck for new couches, vacations, etc. You can also budget the income you’re expecting to receive against the bills you have coming up. Unlike previous systems, you can now «track earnings» through your hours clocked in real-time. This means you always know what’s available rather than waiting on an uncertain deposit.

User’s payroll is linked to the app, not a download. Setup happens at one’s workplace, not via the app. For most users, the core features are free, when provided as an employee benefit. However, the ’employer-sponsored app’ is both its greatest asset and its biggest limitation.

The Access and Availability Dilemma

ONE@Work is only available to employees whose companies have adopted this. If your employer hasn’t joined the platform, the app is practically useless to you; you can’t download it on your device. Thus, it’s not really a universal “money management software” tool but rather a workplace perk. Users have voiced yet another friction point: Instapay access doesn’t always work. Due to employer payroll processing schedules and timecard updates, delays may prevent you from accessing earned wages as you want. A lot of community reports about the early pay app have expressed frustration over inconsistent employer data feeds.

Your employer will usually cover the fees for instant transfers. If they don’t, fees may apply but scheduled transfers are normally free. The app cannot function without internet connectivity and you cannot use it even offline. If your employer does not maintain current work schedules in the app, then it’s of little use.

Who the Pay Advance Tool Serves Best

Employees with low budgets and irregular expenses find true value in ONE@Work. Having visibility on track earnings, having paycheck planning capabilities and getting liquidity immediately can avoid costly payday loans or overdraft fees. The automated savings function creates a safety net each pay period without willpower and transfer.

But the app will work only if your employer has agreed to use the app. Workers who find timecards ignored, or who have a limited Instapay will find the experience frustrating more than freeing. For workers where the workplace is fully on board with the platform and whose data feeds are reliable, ONE@Work reduces financial stress. If your employer isn’t in the network, this option simply won’t work, no matter how much it fits your needs.

No comments yet :(