Lyft Direct powered by Payfare

- Updated

- Version 2.1.11

- Requirements Android 7.1+

- Genre Apps / Finance

Lyft Direct powered by Payfare for Android is a digital banking solution designed exclusively for drivers who earn on the Lyft platform to access their ride earnings instantly through a Mastercard business debit card with no fees or waiting times.

Cash instantly released and cashback you can use

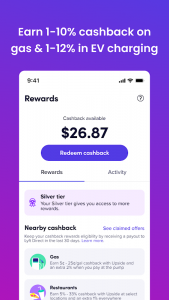

You get paid instantly after every ride. The top feature of the app is that money will get deposited directly into the account. This eliminates the hassle of waiting for a weekly transfer. The real value emerges through the tier-based cashback rewards system. Every time a driver uses this card, they earn 1% to 12% back on EV charging rewards. Plus, they earn up to 10% back on their gas purchases. If you’re a top-tier user, your dining rewards will spike to 5%. Plus, there are more rotating categories to help you rack up the points. This tool helps you easily turn your regular expenses into real savings if you drive hundreds of miles each week.

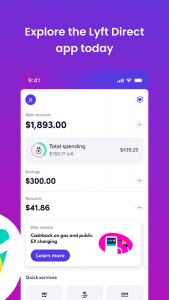

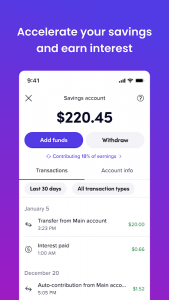

On top of the cashback, the app has a ‘high-yield savings for drivers’ account which lets you setup automated transfers from your earnings. There’s also Spend Insights which analyses your spending and help set budget goals. These are not simply ornaments. They provide a solution to the key issue of gig workers who contend with unpredictable income streams while making future plans.

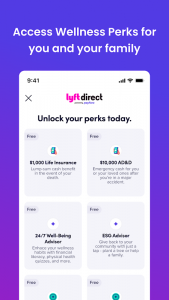

Balance Protection and Wellness Perks

Here’s where the «Lyft banking app» differs from basic payment apps. If you are a qualified user, you may access Balance Protection. It’s emergency funding that provides $50 to $200 when you face unexpected costs. Also, this is much needed when you are self-employed. Drivers of ride-share services can benefit from a ‘debit card’ product which carries no maintenance costs or penalties for low-balance, as well as access to over 20,000 no-cost ATMs across the country for cash withdrawals and deposits.

By accessing wellness benefits through Avibra, contractors receive complementary life and accident insurance which fills a major gap that independent contractors face in not receiving standard employer benefits. The debit card option Mastercard integration works smoothly at the payment terminals. The entire system works with Android 7.1 or higher device.

The Catch? It’s Lyft-Only

This app is only for Lyft drivers, plain and simple. If you are driving for a rival gig platform or working for more than one, you are not qualified. Users have reported that you can’t just be on the platform to have access to certain features. For instance, just joining doesn’t mean you will get Balance Protection. Furthermore, reward rates can vary too much depending on your driver tier status. The app serves as a banking mechanism that is deeply entrenched within the Lyft ecosystem. Accordingly, there is limited flexibility to use it for non-Lyft financial activity.

You do not have the offline capacity, you can access your account only when you have the internet. The app is currently free without any in-app purchases or ads. But due to its tiered benefit structure, the value you will derive actually depends significantly on your driving volume and your status level.

Who is the App service best for

Lyft Direct powered by Payfare provides real benefits for active drivers using Lyft to earn access to earnings, as well as valuable cashback on gas and charging. A unique combination of instant payment, high-yield savings for drivers as well as no maintenance fees and emergency Balance Protection provides complete financial wellness for those who ride-share for work. The platform’s exclusivity and tier-based benefits mean casual drivers or those working on multiple platforms should assess whether the feature set matches with their actual usage patterns before making a commitment.

No comments yet :(