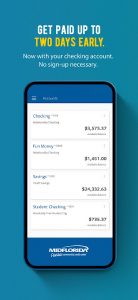

MIDFLORIDA Credit Union for Android offers complete mobile banking for credit union members who want complete control of their finances from their smartphone. It allows you to check balance daily and have access to sophisticated money management tools. You can now enjoy the same experience as the branch in your pocket with a security-first architecture. Automation tools will help your savings grow on autopilot.

What you will get after enrollment

With the app, you can manage all your accounts, not just your MIDFLORIDA account. “Transaction History” and external bank balances can be viewed in one place. you can easily view Everything on one page without toggling to an app. Mobile check deposit allows you to take pictures of checks for immediate processing. Fund transfer capability helps you seamlessly transfer funds between internal accounts and external accounts. The “bill pay” feature takes care of recurring payments, and the direct deposit setup even includes the option of accessing paychecks early, which is a real advantage for members living paycheck to paycheck.

Card controls represent one of the standout features. You can instantly lock and unlock your debit card. You can set spending limits and block transactions by merchant category or type. The rewards system for your debit card is incorporated into the app. You can easily monitor and redeem your points from within the app, without needing the customer service or branch. Smart Save is a function that takes it up a notch by rounding up your purchases to the nearest dollar and sending the change into savings. It’s an automated way of saving.

Security Meets Financial Education

«Account security» runs deep here. Every login and transaction is secured with two-step authentication and an advanced encryption technology. Connect to your bank through Plaid to get visibility of apps that use your data. You’re informed of transactions and account balance changes in real-time so if any unauthorized activity takes place, it gets flagged immediately. But security isn’t the only focus. The app has money management tools to help customers develop better money management skills, which is not usually the case. Budgeting tools and goal tracking features help you put savings targets in place and track how much progress you’ve made. You can do all this without the need for messy spreadsheets.

The Technical Reality and Limitations

Some friction points pointed out by users should be known to the member. Mobile deposit can be buggy for some users because they have reported that the app crashes during the process. Some updates have caused logging in issues that have locked members out of their accounts. The catch? You have to be a MIDFLORIDA member signed up for online banking to use the app at all; it is not for prospective users comparison shopping. When a device runs low on storage, it affects the applications on that device. It also slows down the overall performance of the application.

The app comes free of in-app purchases and ads which makes it clutter-free and the focus is only what’s essential for banking. You will need an internet connection to use all the features of the app.

This app is a true command center for personal finance for MIDFLORIDA Credit Union members. The app is better than the bare-bones banking apps because of «savings automation», extensive card controls, huge account integration and educational content. If you’re willing to put up with glitches, you can expect a full suite of features, tasked to help build better money habits while putting the term «account security» front and centre.

No comments yet :(